School’s often struggle with a complex employee and payroll environment. As a first step to simplifying this process, we recommend introducing a Cost to Company package as this goes a long way to making life a lot easier for everyone involved.

Typically, within the school environment, employees operate with different hats on, whether they are teachers, heads of departments, house masters, sports coaches… the list goes on. In order to compensate employees for their roles and attract the right talent, schools tend to offer a variety of different allowances and incentives. This makes it very difficult to keep track of employee remuneration, bonuses and increases, and also creates significant compliance risk. Is each item being taxed in the right way? Are all benefits being considered? What if SARS or the Department of Labour undertakes an audit?

As an alternative, let’s take a look at a ‘Total Cost to Company Compensation (TCTC) package’.

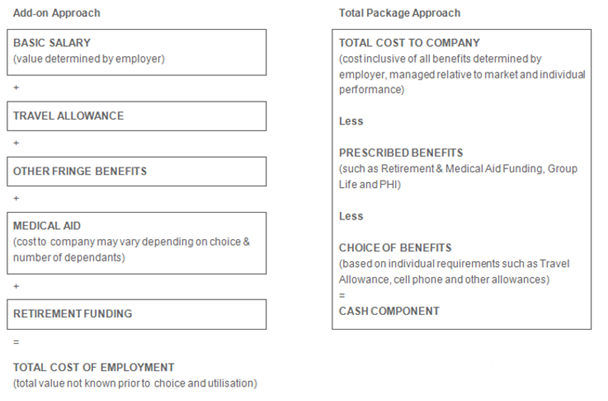

TCTC is a different way of viewing remuneration. It moves away from the traditional, ‘add-on’ approach of determining a basic pay to which a number of benefits are added. With TCTC, the starting point is the Total Cost to Company remuneration figure from which employees have a choice to exchange cash for benefits relevant to their circumstances, and within current legislation.

But why change the way the employer manages pay?

The change benefits the employer in a number of ways:

- It is easier to perform market comparisons and work out what fair and equitable remuneration is for different employees.

- It is easier to offer employees a variety of employee benefits at their election of how they wish to structure these benefits.

- It is easier to manage the annual increase process as the increase is driven off the TCTC and doesn’t have to be applied to all the payroll elements.

- The remuneration for each employee is referenced to one TCTC figure, making the budgeting process far simpler.

- It is easier to compare packages across different elements and skill sets, and to have add-on components only where these reflect very different work and responsibilities.

- It is easier to show new recruits exactly what to expect on their payslips.

How do employees benefit from this approach?

- Employees benefit from greater transparency on their full employment cost.

- TCTC packages can be combined with different employee benefit options to give the employee the choice of whether they would prefer to take home more pay or take advantage of the benefits offered (depending on how the employer structures this).

In other words, employees benefit by being able to use the flexible structure to optimise their take-home pay both now and in the future. Or they are able to better meet their lifestyle requirements – for example a person may wish to increase their pension fund contributions (within the existing rules of the fund) once their medical aid dependents decrease.

Does a move to TCTC increase payroll costs?

The simple answer is it shouldn’t. However, if done badly then it may very well lead to increased costs. For example, it is important to understand contractually what one’s obligation is for contributions to insurers for post-retirement and risk benefits. An increase to TCTC may trigger an increased payroll cost even if this is contractually not required.

It is important to work through a proper process to make this change, including consulting directly with employees and making sure contracts of employment are aligned. We also recommend showing your staff the impact on them personally from the change, with a pre- and post-payslip or similar illustration.

The move to TCTC can also be used as a way to introduce employee benefits (such as life cover, post-retirement benefits, dread, disability and other cover) into your organisation, without increasing payroll costs.

If managed properly, the move to TCTC does not add anything to existing payroll costs, and has the ability to protect the employer from future legislative payroll surprises.

If you would like to talk to an expert about a TCTC move or any of the other ways HRTorQue can help your school or business, please contact us on [email protected].