We are often asked the question by clients what they should do in the face of interest rate increases. This is often accompanied by the question, “Will interest rates go higher?”

We are no better than most at staring into a crystal ball and trying to predict the future. Instead we recommend clients think about a couple of things whenever they are considering taking out debt where they will be required to make payments to a lender based on an interest rate. These factors then influence whether they should take the debt out in the first place:

- Can I afford the debt if interest rates rise (or rise further)? The biggest risk you face in buying a property is not being able to afford the interest payments should interest rates rise. This could lead to a foreclosure and the loss of the equity you put into the property and negatively impact your ability to borrow in the future. When you take out debt think about whether you can afford to make interest payments if interest rates rise by 5% (or even to historic highs) and for how long. If you cannot afford the interest payments when interest rates rise by only a few percentage points then you probably cannot afford the asset you are buying.

- If I lose my main source of income, can I afford the interest and debt repayments? When we buy a property, we always assume we will have our jobs to pay off the mortgage. What if we lose our jobs and are made redundant. While sometimes we can bounce back soon, if your redundancy happens when the economy is slow it might be quite hard to find a new job and in the interim you may fall behind on your mortgage payments. It may also happen that you lose your source of income because of an illness or physical accident. If this is a potential risk for you and you don’t have a backup plan then consider some form of insurance like an income protection or dread disease or critical illness cover.

- Carry out a liquidity test and consider how long you could make all your monthly outgoing payments without any income from your primary source. If you can stretch this out beyond 12-18 months you are in a strong position. If not, you are tightly stretched.

The above is all very well, but what does one do now when interest rates have already increased. There are a few things to think about:

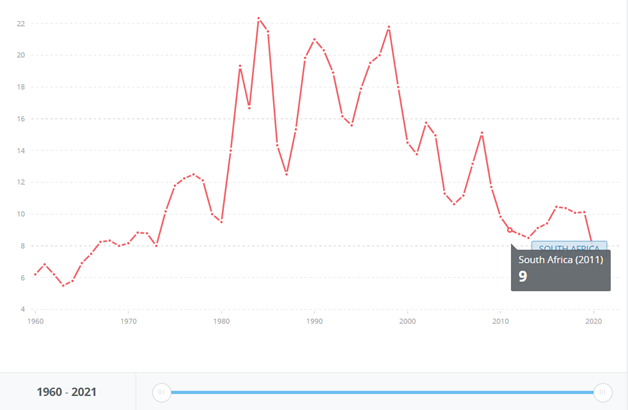

- Interest rates may get higher before they come down again. Historically, interest rates have reached over 20% in South Africa and lending interest rates are still below historical peaks.

(source: world bank) South Africa - If you are struggling to meet interest payments at current levels, be careful hoping they will go down, because they might not. We would recommend one of the following:

- Talk to your lender to make payment arrangements and consider alternative arrangements (may be challenging)

- Try and make savings elsewhere and either put this into an offset mortgage / access bond (if you have this) to reduce interest payments or alternatively try and repay the capital on your debt

- Be careful of paying off your interest using other debt. This may seem like a good short term solution, but most likely it will make things worse in the medium term as credit cards and unsecured debt usually carry higher interest rates.

And, if you are in the strong position of having extra cash then take advantage of the higher interest rates you can earn on your money. For many years pensioners have suffered because of low yields, so for once they can benefit from a better return.

We are not debt specialists, but if you are looking for ways to make savings with your finances then do reach out to one of our consultants. We are confident we can find ways to help you.