(Source: crs.co.za)

The Contribution Sociale Généralisée (CSG) Regulations 2020:

Regulations made by the Minister under section 30F of the National Pensions Act were published in Government Notice No. 214 of 2020. As from 1 September 2020, the National Pension Fund is being abolished and replaced by a new system, the Contribution Sociale Généralisée (CSG), a progressive contribution system.

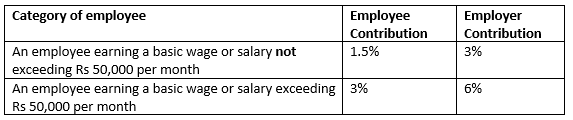

Under the CSG, employers are required to deduct, where applicable, the employee’s contribution from his/her wage or salary and pay that contribution, together with the employer’s contribution, to the Mauritius Revenue Authority (MRA). The rate of contribution applicable to the private sector is shown below.

Basic wage or salary means:

- Where the terms and conditions of employment of the employee are governed by Remuneration Regulations or Wages Regulations, an arbitral award or an agreement, the basic wage or salary prescribed, or where the employer pays a higher wage or salary, the higher wage or salary paid, excluding any allowance by any name and whether paid in cash or in kind.

- In any other case, all the emoluments received by the employee, excluding any bonus or overtime.

The monthly return and payment of CSG with respect to a month is required to be made electronically on or before the end of the following month.

An exception was made by the MRA for the month of September 2020. The last date for submission of the return and payment of CSG to the MRA is 30 November 2020.

Facilities for the electronic submission of CSG returns are available on the MRA website. Employers must use the same employer registration number (ERN) and password applicable for the submission of NPF return.