Author: Harusha Naidoo

The Compensation Fund is covered by the Compensation for Occupational Injuries and Diseases Act (No 130 of 1993) (COIDA) and the Compensation for Occupational Injuries and Diseases Amendment Act (No 61 of 1997). The main objective of the Act is to provide compensation for disablement caused by occupational injuries or diseases sustained or contracted by employees, or for death resulting from injuries or diseases, and provide for matters connected therewith.

Anyone who is employed under a contract of service and receives wages, salary on weekly or monthly basis may claim compensation in terms of the Act’s. Dependants of an employee who is fatally injured can also claim compensation. Casual employees’ rights are exactly the same as full-time employees.

The Fund generates its revenue from levies paid by employers, and this consists of annual assessments paid by registered employers on a basis of a percentage or fixed rate of the annual earnings of their employees. The COID Act, however, makes provision for a minimum assessment to ensure the assessment is not less than the administration costs incurred.

Government Gazette 49458 Notice 2079 of 2023 was published on 13 October 2023, whereby the Minister of the Department of Employment and Labour informed all relevant parties of the increase to monthly pensions with 7.5% with regards to accidents which occurred before 31 March 2023, and occupational diseases which were diagnosed before 31 March 2023. The increase is to be effective from 1 April 2023.

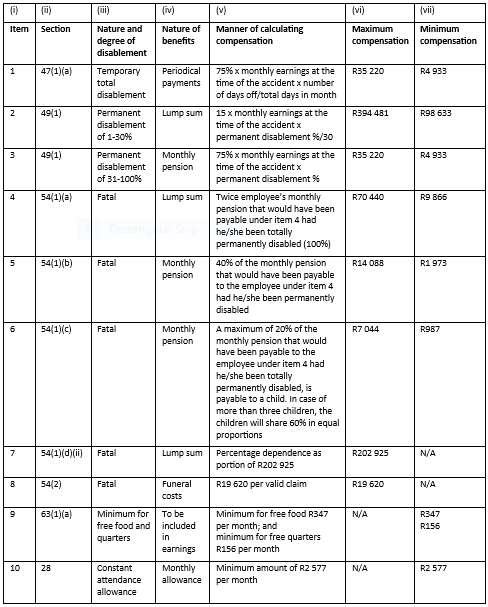

Schedule 4 to the COID Act on the manner of calculating compensation has also been amended and prescribed according to the minimum and maximum compensation for accidents that occur from 1 April 2023 as well as occupational diseases diagnosed from 1 April 2023.

Recommended benefits from 1 April 2023:

Temporary disability – If the doctor indicates in the medical reports that you have a temporary disability (a minor injury) you will only get 75% of the earnings you were receiving at the time of the accident. This will only be paid during the time that you are unfit for duty, recovering as a result of injury. The Fund does not pay for pain and suffering.

Permanent disability – If the doctor indicates in the medical reports that you have a permanent injury, such as deafness, blindness, amputation of a limb or an injury that permanently disables you (for the rest of your life), it will be assessed according to the percentage of disability laid down in the Act. If your disability is assessed at 30% or less, you will be paid a lump sum, which is a once-off payment for that injury. If your disability is assessed at more 30% you will receive a monthly pension together with the arrears payment from the date of stabilisation of your condition which is reflected on the Final Medical Report, and a monthly pension is payable for life. The amount of this pension is calculated on your earnings at the time of the accident, your percentage of disability and the benefits applicable at the time of the accident.

Fatal – When an employee dies as a result of the injury or disease, his or her dependant’s widow or widower will get a pension for life. All children under the age of 18 years will qualify and will be included as part of the parent/guardian’s pension. This pension will stop when the child reach 18 years unless he/she is still at school or attending a tertiary institution.

Click here to download the Government Gazette Notice:

https://www.gov.za/sites/default/files/gcis_document/202310/49458gen2079_0.pdf

Chat to one of our experts today for any pension or benefits advice.