On the 30th May, the Department of Employment and Labour published some important information pertaining to COID in Government Gazette No. 48673.

Firstly, the deadline to file a Return of Earnings was extended to the 30th June 2023 (the 31st May is usually the annually extended deadline).

The second notification was the confirmation of the annual earnings threshold of R 568 959 (which had been reported incorrectly by the Department of Employment and Labour previously). However, this confirmation has come far too late for the majority of employers who have already submitted their returns containing provisions with the incorrect threshold amount.

This Gazette also finally confirmed that domestic employees are now included in the definition of ‘employee’ in terms of the Compensation for Occupational Injuries and Diseases Act (COIDA), and that they receive the same protection and benefits all other employees currently receive. While this change has only recently been signed into law, the Compensation Commissioner has been processing domestic registrations and accepting Return of Earnings declarations for over a year already.

In terms of the new Act, an ‘employer’ is anyone, including the state, who employs at least one employee. This will now include private citizens who employ a domestic worker.

If an employee’s services are ‘let, lent or temporarily made available’ to someone else, that person is considered the employer for that period. So, in the context of domestic workers, whoever pays the domestic worker in question is regarded as the employer for purposes of the fund, for whichever duration, and will be required to comply with the Act.

A reminder to employers that the minimum COID assessment for the 2023 Return of Earnings submission is R 1 443. For domestic employers it is R 498.

While the inclusion of domestics in the definition of ‘employee’ is a long time coming and is to be congratulated, the change is going to increase the administration burden on the employers of domestic workers. We have seen a very low compliance rate in terms of UIF registrations in the domestic employer space and expect even fewer of these employers to register for COIDA purposes. This places both employees and employers at significant risk should there be a death, injury or illness in or as a result of the work environment.

In other COID-related news the Compensation Commissioner’s Office is stepping up legislative compliance initiatives. This includes the appointment of external auditors to look at the previous submissions, and in particular, how the employer arrived at ‘COID earnings’. We are aware of cases where large assessments have been raised due to a differing interpretation of ‘regular earnings’. This interpretation will be less of an issue when the definition of ’earnings’ is officially changed to ‘remuneration’ as defined in the Fourth Schedule to the Income Tax Act. This will be a positive step towards getting uniformity in treatment of the definition of ‘earnings’ between the various Acts that govern payroll. Until then, there will be an unacceptable level of uncertainty which will make the completion of any audits significantly more challenging.

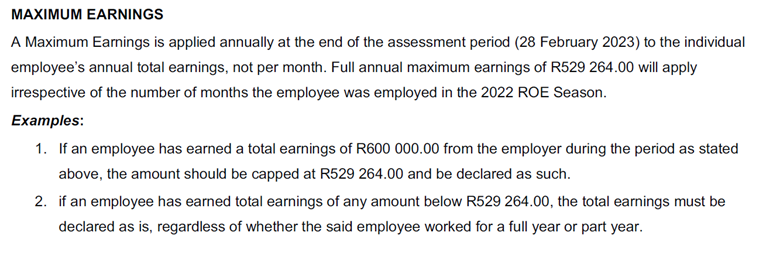

Finally, the COID issue that has caused the most unhappiness is the following clause relating to the maximum earnings threshold:

Payroll systems are all designed to apply a monthly amount of R 44 105 as COID earnings in cases where employees earn above the annual COID threshold of R 529 264 (the 2022 threshold). This amount would be applied evenly through the year to ensure that the COID earnings for the employee does not exceed the threshold.

The challenge that the above-mentioned declaration raises is explained in example 2. If an employer only worked for a couple of months for company 1 and was then transferred to another company in the group, the COID earnings that should be declared on the original payroll for the year is the actual earnings, limited to the earnings threshold of R 529 264. As an example, an employee earning R 150 000 per month for three months would have COID earnings of R 450 000 for the year instead of the projected R 132 315 earnings that payroll systems would reflect. That employee may then only work for company 2 for three months and then move onto company 3 for the balance of the year. The COID earnings for that employee between the three payrolls would far exceed the R 529 264 that would be applied if that employee had stayed on one payroll.

The application of the annual threshold in this manner has created massive risk for employers where this movement of employees may have happened. The COID earnings will be considerably understated, and the employer would be exposed to an additional payment, a penalty and interest, should there be an audit. The Payroll Authors Group of South Africa (PAGSA) has sent an urgent letter to the Compensation Commissioner’s Office stating that it is unfair to make such a notification after the end of the year of assessment and explained that it would be extremely difficult for employers to manually make such corrections before the deadline on the 30th June 2023. For those employers who have already submitted their Return of Earnings this would require the submission of a revision form, redeclaring the COID earnings for the year and adjusting the provision for the 2023 year. This revision process is no easy task, and in our experience can take over a year to resolve.

Any change in application of this threshold would require payroll changes. As we are already four months into the new year of assessment it is quite late to be even making changes for the 2023 COID year of assessment. We are hoping that the Compensation Commissioner will see the error of their ways and postpone the application of this amended clause. We will publish any further amendments as soon as we receive them.

For assistance with any COID-related matters, contact us today.