Author: Khutso Makgoka – (Admitted attorney specialising in tax law – SAIL International)

In today’s global economy, investing across different countries and markets is an attractive strategy to increase your wealth and reduce the risk on your investments. However, with different countries comes different tax collectors, and lack of tax planning can negatively impact not only your wealth strategy, but your continued return on investment too.

As part of your overall wealth strategy, the question of who holds the right to tax your global assets is critical. We set out some considerations to keep in mind when operating in multiple countries:

- What are global assets?

When we talk about global assets, we are referring to a wide range of assets either owned in your personal capacity or nestled in a legal entity, but importantly located in different countries (other than your home country). These assets can range from physical assets (such as commercial and residential properties) to precious metals, antiques and collectables, and digital assets (such as cryptocurrencies, Bitcoin or Ethereum).

- Where are the assets located?

Tax can be charged on where your assets are physically located (also known as ‘situs rules’). For commercial and residential property, this is an easy tax assessment. However, it can get quite complicated when we look at assets that do not have material existence or a set physical location, like digital assets or share portfolios, or where the assets tend to move as you move such as art.

- Your tax residency status

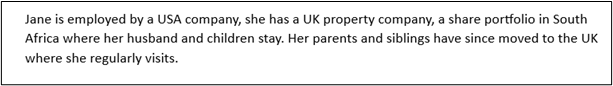

Tax can be charged based on where you are considered a tax resident, regardless of the location of the assets. Tax residence is a complex tax concept, different from country to country, relying on various assessments such as ties to a country and days spent. Let’s take a look at the example below:

In this instance, the residency assessment would be relevant for South Africa, the United Kingdom and the United States of America, all of which operate on different rules for tax residency.

Given the complexities of tax residency and tax on the location of assets, more often than not, there will be a conflict between the tax legislation in your home country and the tax legislation in the foreign country where your assets are located.

Withholding taxes

One such conflict arises from the requirements for withholding taxes, which are applied by a country’s tax authority as a mechanism to collect taxes and prevent tax avoidance. The rules for automatic deduction will differ in each country, with the most common type being PAYE tax. However, withholding taxes also affects income generated from the assets such as dividends and interest income, and may sometimes lead to double taxation.

Double tax agreements

To address issues of double taxation, double tax agreements (DTA) are established between various countries and seek to eliminate the impact of double tax and to clarify which country will tax what income. The main goal for these agreements is to resolve the conflict between where tax is charged in your home country and where tax is charged where the asset is. In resolving this, the DTA will allocate taxing rights to only one country, eliminating the need to pay tax charges in more than one country. It is important to note however, that not all countries have a DTA concluded and/or signed, and that the application of these agreements is not automatic.

Estate planning

Lastly, and often least considered, tax paid on your estate when you pass on may account for the largest tax leakage. Most countries will have their own rules regulating tax payable upon death based on location, residency and the existence of a DTA. In the absence of a proper succession plan, the tax rates levied in a foreign country may be in addition to the taxes payable in your home country upon your death. Going back to the example of Jane, in the case of her death her estate would be liable for 40% USA inheritance tax in addition to 40% UK inheritance tax, as well as 20 to 25% RSA estate duty tax. While some of these can be alleviated with the DTA, there is no substitute for good planning.

The global tax playing field is complex. We strongly advise you to seek the right advice to avoid the pitfalls and better still, take advantage of the opportunities this creates for you as an individual and business owner. Contact us today to see how we can help you.