|

| Table of Contents |

1. Can I still use labour brokers in my business?

2. Cost-effective Alternatives to using Labour Brokers

3. Directives and Severance Benefits

4. Employment Tax Incentive and the Special Economic Zones

5. Labour Broking Alternatives - Free HRTorQue and MacGregor Erasmus Seminars

6. Contact HRTorQue

Should you require any further detail on any of these topics, please feel free to contact us. |

| Top of Page |

| |

| 1. Can I still use labour brokers in my business? |

Author: Bruce MacGregor (Macgregor Erasmus Attorneys [email protected])

|

Last week, the Constitutional Court clarified a section of the Labour Relations Act regulating labour brokers. There have been a number of rather confusing articles and advice circulating since and the intention of this article is to try simplify things and explain what is actually going on.

Brief History of Labour Broking

In 1996, when the Labour Relations Act (LRA) was created, labour brokers were re-named Temporary Employment Services and, as the name implies, their service was associated with the temporary placement of staff at clients. For a number of reasons, these staff often ended up working for long periods of time and/or indefinitely, resulting in complaints from unions that companies were using labour brokers to underpay staff or to get around the Labour Legislation, with respect to key issues such as terms and conditions, collective issues and dismissal law.

Government Intervention

The Government reacted by amending the LRA with198A. In substance, what the Government introduced was:

| • |

Companies who wished to use labour brokers in genuine, temporary work could continue to do so with the labour broker remaining the employer at all times; |

| • |

In respect of people who earned over the threshold being R17 119.44 per month (R205,433.30 per annum), these employees would remain the employees of the labour broker (as the LRA would not apply); |

| • |

However, in respect of employees who weren't employed in temporary capacities, and were employed at the client beyond three months, they would be deemed the employee of the client and, more importantly, the client was obliged to treat the employee on the whole, no less favourably than their own staff, i.e. they needed to give them all the benefits and salaries their own staff received. |

Litigation

The labour broker industry challenged the legislation, which went through a number of Courts ending up at the Constitutional Court, who have now confirmed the following:

| • |

In respect of employees provided by labour brokers who will engage in temporary assignment i.e. to replace someone who is sick and the like, the labour broker will remain the employer and it will be business as usual; |

| • |

However, where a labour broker places an employee at a client, after a period of three months the client becomes the sole employer of the employee. |

What role then does the labour broker play?

The Constitutional Court says that the labour broker (whilst there is still a contract between the client and the labour broker) will remain as a party and they will continue to run the payroll and undertake whatever duties they are supposed to in terms of their contract with the client. This is known as the so called "triangular relationship". They are, however, no longer the employer after the three-month period.

Once the contractual agreement comes to an end, the labour broker falls completely out of the equation and the client will proceed with the employment relationship in the normal course with that employee.

Future CCMA Matters

The labour broker employees, after three months, become the client's employees and will refer matters to the CCMA against the client. If the client has an agreement with the labour broker, then the employee can also refer the matter against the broker, but this is probably an unlikely scenario as it is anticipated the client would have deeper pockets and, in many cases, be less able to protect themselves if they have abdicated responsibility for managing the employee to the labour broker.

Worrying Issues - Backdated Benefits

The big issue to be concerned about is the fact that should you have had labour broking staff on site for a period of more than 3 months, especially if they have been there at any time since 2015, you may face a claim for the difference between salary and benefits paid and what should have been paid compared to your other staff i.e. a backdated calculation.

Conclusion

As an employer, there is no practical restriction on your continuing to use a labour broker. However, you take on considerable risk if you continue to use the services of a broker for individuals paid under the LRA threshold, as you would be taking on the full risk of employment (and any risks associated with unequal pay) with the relationship being managed by a third party. In these circumstances, we would suggest it would be better to treat the relationship as it actually is i.e. the individuals are your employees and if you need a third party to manage them, manage payroll, or HR, then you should engage the third party on this basis to do these services, with appropriate service level agreements in place. |

| Top of Page |

| |

| 2. Cost-effective Alternatives to using Labour Brokers |

| Author: Jonathan Aitken |

Many employers in South Africa use labour brokers (TES). Often, they continue this practice because they don't feel able to manage the volume of workers together with the HR commitment (some employers may only have ~100 permanent staff, but engage 1,000 temporary workers). Following the ConCourt ruling, employers are scared they will not be able to manage the additional workers internally and the additional cost will put them out of business. This is not the case and there are alternatives available to employers that should result in minimal extra work for them and marginal to less cost depending on how they approach the transition.

What does a labour broker do?

A labour broker effectively performs a number of tasks for an employer including:

• Recruiting and contracting workers

• Managing these workers (the client would manage them operationally)

• Run payrolls and pay the workers

• Manage relationships with third parties including unions/bargaining councils

• Manage IR issues and terminate the workers' employment

Potential Options

Employers in the face of the Concourt ruling could choose the following options:

• Do nothing and face significant financial risk; or

• Engage the TES workers directly and manage them internally; or

• Engage the TES workers directly and outsource the processes performed by the labour

broker previously

Comparison of Options

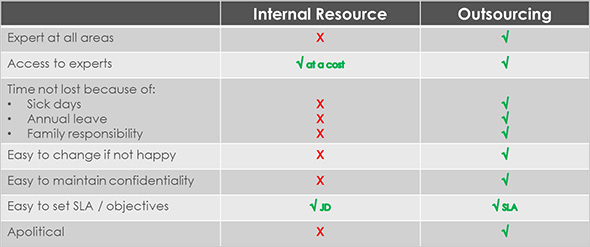

The table below illustrates the comparison between trying to manage the TES workers internally and outsourcing. We don't look at the option of doing nothing because it really doesn't make much sense financially or form a risk perspective.

Cost Comparison

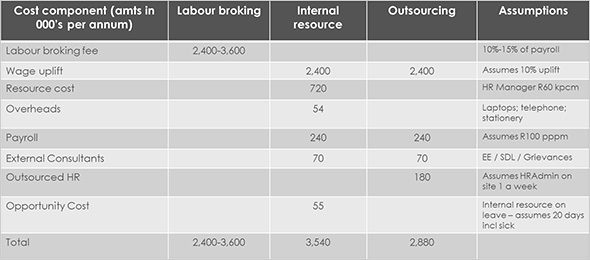

As cost is a significant factor we have also included a comparison below between labour broking services, managing internally and outsourcing. We have assumed a company with 200 TES workers currently and assumed a current labour broking fee of between 10% and 15% of payroll.

For a more detailed overview the table below illustrates the key assumptions and working for each element.

The above table does not consider any savings through efficiency gains by managing and controlling the workers better. Previously there would have been no incentive to upskill.

Conclusion

Outsourcing is a clear option to better manage your risk and financial exposure if you currently use TES workers. We would recommend you do a review of your business and individual circumstances before you make a decision. If managed well the transition has the potential to improve your business. |

| Top of Page |

| |

| 3. Directives and Severance Benefits |

| Author: Karen van den Bergh |

In simple terms, and dealing with employees only, a "severance benefit" is defined in the Income Tax Act as a payment of a lump sum by an employer (i.e. not paid by a retirement fund or from the proceeds of an insurance policy) to an employee in respect of the relinquishment, termination, loss, or variation of the employee's employment under circumstances where:

| 1. |

The employer is 55 years of age or older |

| 2. |

The employee cannot continue working due to sickness, accident, injury or incapacity through infirmity of mind or body |

| 3. |

The employer discontinues the trade in which the employee was employed or makes the employee redundant by reducing staff. |

Severance benefits are also described as 'Voluntary Severance Packages'.

Taxation Rules

Severance benefits are taxed using the same tax table as used for retirement fund lump sums.

Table: Retirement Fund Lump Sum Table (including Severance Benefits):

| Taxable Income |

Percentages and Brackets |

| 0 - 500 000 |

R 0 + 0% of each R1 |

| 500 001 - 700 000 |

R 0 + 18% of the amount above R500 000 |

| 700 001 - 1 050 000 |

R 36 000 + 27% of the amount above R 700 000 |

| 1 050 001 and above |

R 130 500 + 36% of the amount above R 1050 000 |

This table must be applied on a cumulative basis by taking into account severance benefits and any retirement fund lump sums paid previously. Payrolls cannot apply this table because the payroll does not have a record of these prior lump amounts paid to the employee.

Only SARS have the records to be able to apply this table correctly and employers must apply for a tax directive from SARS to be able to withhold the correct employees' tax amount.

Directive Rules - IRP3 (a)

SARS have confirmed the following directive application procedures for the taxation of a payment by an employer of a severance benefit.

Prior to September 2017, when an employer selected "Severance Benefit - Voluntary Retrenchment" on the IT3 (a) directive application, the normal income tax table was incorrectly used to determine the employees' tax to be withheld from severance benefit lump sums. This was corrected by the final income tax calculation on assessment where the severance benefit tax table is used for severance benefits reported as code 3901 on the tax certificate.

From September 2017, the Tax Directive system was amended and the severance benefit tax table is now used to determine the employees' tax amount stated on the tax directive if the reason "Severance Benefit - Voluntary Retrenchment" is selected.

If the employer used the reason "Other" and in the description field entered 'Voluntary retrenchment' instead of using the correct box (historically we saw people doing this because they were worried that under the old practice they would not get the R500,000 exemption), these directives must be cancelled and resubmitted with the reason "Severance Benefit - Voluntary Retrenchment" to ensure that the assessment calculation is correct.

The following 'Reason' options can be selected on the IRP3 (a) directive application form:

1. Severance benefit - Death

2. Severance benefit - Retirement (age of 55 or older)

3. Severance benefit - Retirement due to ill health

4. Severance benefit - Involuntary retrenchment

5. Severance benefit - Voluntary retrenchment

Tax Certificates

The following codes must be used to report the severance benefit amount and its related employees' tax amount on tax certificates:

• Code 3901 (Gratuities / Severance Benefits (PAYE))

• Code 4115 (Tax on retirement lump sums and severance benefits).

Note:

If the employer has incorrectly used code 3907 for the severance benefit the amount will be treated as normal income and taxed using the income tax table on assessment without the R500 000 exemption allowed by the severance benefit tax table.

The employees' tax withheld in accordance with the directive must be reported on the tax certificate as code 4115 and not as normal PAYE (code 4102). |

| Top of Page |

| |

| 4. Employment Tax Incentive and Special Economic Zones |

| Author: Karen van den Bergh |

This article looks at the practicalities of ETI as it relates to clients of HRTorQue and then looks at the practical implementation of ETI as it relates to SEZs.

A number of employers have not yet taken advantage of the Employment Tax Incentives "(ETI)" initiative on offer by SARS. There are a number of challenges and risks around activating this incentive, but if managed properly significant, real benefits can flow to the employer.

The Employment Tax Incentives (ETI) was designed to encourage employment of young individuals and is a valuable tool for employers to recover funds from the state. It has been extended a few times already and we have recently heard it has been extended further (to be confirmed).

If you are a client of HRTorQue's and you have activated ETI you should be aware of the following:

| • |

If you do choose to have ETI activated, you will receive a monthly report with your test reports showing who the current calculation on your payroll. It is very important that you note that you can only claim ETI for your organisation if you are currently in good standing with SARS, in all your tax types. |

| |

|

| • |

We cannot access your current standing with SARS, this can only be done by the person that holds the efiling "Income Tax" profile. We only have access to the PAYE profile in most circumstances, so we are completely in your hands when it comes to knowing if you are in good standing.

If you are currently NOT in good standing with SARS, you must tell your payroll team to remove the ETI from your payroll before you run live, for the current month payroll. Your payroll team will then move the ETI calculated for the current month to a "calculated but Unclaimed status" for our payroll administration team to reserve these funds with SARS via the EMP201 submission for future use, if possible, within the relevant tax seasonal time frames, (as explained on the refund document below). |

It is important to note that it is extremely difficult and a significant risk to your organisation to attempt to withdraw the ETI post submission and payment to SARS. Please make note of this important issue and help us keep you safe in this regard.

Here is a link from SARS that explains how to claim, post the current period, if you are not in good standing, and the process that is followed.

The 1st August 2018 brought us more changes in this process as SARS finally gazetted the Special Economic Zones for ETI.

Designated Special Economic Zones and ETI Act

On 6 July 2018, the Minister of Finance published Gazette No 41759 designating six Special Economic Zones (SEZ's) for the purposes of section 6 (ii) of the employment Tax Incentive Act, No-26 of 2013 (the ETI Act).

With effect from 1st August 2018 and for the purpose of the ETI act the 6 designated zones are:

1. Coega (PE AREA)

2. Dube Transport (KZN)

3. Industrial Development Zone (East London)

4. Maluti-a-Phofung (Bethlehem area)

5. Richards Bay (KZN)

6. Saldanha Bay (Western Cape)

Boundaries and other details of these SEZ's can be found in Gazette number 41758.

One of the criteria that must be satisfied before an employee can qualify to generate an employment tax incentive for the employer is that the employee must be not less than 18 years old and not more than 29 years old at the end of the claiming month.

However, section 6(a) (ii) of the Employment Tax Incentive Act provides as follows:

"6. Qualifying employees. - An employee is a qualifying employee if the employee -

(a) (ii) is employed by an employer operating through a fixed place of business located within a special economic zone designated by notice by the Minister of Finance in the Gazette and that employee renders services to that employer mainly within that special economic zone; or"

The age requirement for ETI therefore does not apply where:

1. The employee provides services mainly to an employer in a designated SEZ, and

2. The employer operates through a fixed place of business located within that SEZ.

Fixed Place of Business

The six SEZ's designated by the Minister of Finance have clearly defined boundaries, to comply with the first requirement, the employer must operate through a fixed place of business located within the defined boundaries of the SEZ.

If the employer has branch offices, the employer satisfies the first requirement if one or more of the branch offices operate through a fixed place of business within one or more of the six designated SEZ's. A branch office is not a separate legal entity from the business under which it operates, therefore it is irrelevant whether the branch office or the business is regarded as the employer for purposes of section 6 (a) (ii), as both form part of one legal entity.

Note that an employee's residential home will not constitute a fixed place of business for the purpose of section 6(a) (ii) of the ETI Act.

Rendering of Services Mainly within an SEZ

The word "mainly" in the income Tax Act means 'more than 50%', and this principle is applied to section 6 (a) (ii) of the ETI Act. This would be measured per month (ETI is administered on a monthly basis). Secondly, the employee must render more that 50% of his or her services per month physically within a designated SEZ where the employer has a fixed place of business (as discussed above).

Application of the Section 6(a) (ii) Requirements

In practical terms, the following three criteria must be met by an eligible employer in order to satisfy the requirements of section 6(a) (ii):

1. The employer must operate through a fixed place of business, and

2. The fixed place of business must fall within a designated SEZ, and

3. The employee must render services to the employer mainly with that SEZ

The result is that the ETI claimed under section 6(a) (ii) is ultimately 'ring fenced' to the employees rendering services mainly within that designated SEZ.

The same principles apply if the branch office is registered separately for PAYE from the business.

Tax Certificate Codes for SEZ's

While the Government Gazette that designated the six SEZ's was published on 6 July 2018, the effective date is 1 August 2018. Employees who qualify in terms of section 6(a)(ii) in the month of August 2018 must be reported on tax certificate for the August 2018 mid-year tax certificate submissions.

What do you do if you want to claim ETI?

HRTorQue has considerable experience in managing ETI calculations and applications. We are experts at reducing client stress by managing these types of administrative tasks on their behalf.

For the maximum benefit in relation to claiming ETI, we recommend contacting your payroll team leader who will guide you through the process. |

| Top of Page |

| |

| 5. Labour Broking Alternatives - Free Seminar |

| Author: Jonathan Aitken |

HRTorQue and MacGregor Erasmus are pleased to invite clients on a first come first served basis to our free seminar on alternatives to using labour broker workers in your business.

The seminars will be held on the dates below in Durban, Cape Town and Johannesburg and will cover the following areas:

| • |

The aftermath and need for new staffing models arising from the recent Constitutional Court judgment and how it flattens the playing field by limiting quite strictly how and when Labour Broking staff may be used; |

| • |

Exploring efficiencies in employing Broker staff in-house and the options available in HR management and optimisation; |

| • |

Testing whether other outsourced services will be deemed Labour Broking staff and be met with similar challenges; |

| • |

Tax implications and practical questions regarding remaining tax compliant on respect of independent contractors, FTC staff, casuals and the like. |

Durban: 30 August

Cape Town: 29 August

Johannesburg: 3 September

To book a place, please contact [email protected] |

| Top of Page |

| |

| 6. Contact HRTorQue |

Durban

Phone: 031 564 1155 • Email: [email protected] • Website: www.hrtorque.co.za

Address: 163 Umhlanga Rocks Drive, Durban North, KwaZulu-Natal

Johannesburg

Ground Floor, West Wing, 6 Kikuyu Road, Sunninghill, 2191

Cape Town Office

Ground Floor, Liesbeek House, River Park, Gloucester Road, Mowbray, Cape Town, 7700

Bloemfontein Office

62 Kellner Street, Westdene, Bloemfontein

East London

24 Pearce and Tecoma Street, Berea, East London

Port Elizabeth

280 Cape Road, Newton Park, Port Elizabeth

Polokwane

125 Marshall Street, Polokwane

Nelspruit

Promenade Centre, First Floor, Suite 11A, Nelspruit |

|

|

|

|