|

| Table of Contents |

1. Affirmative Action Measures and Employment Equity

2. Should alcohol be permitted at work functions?

3. Let the Truth be Told

4. Medical Certificates - Traditional Healers

5. National Treasury to Delay Implementation of National Retirement Reform

6. Employment Tax Incentive (ETI)

7. Bursaries / Scholarships

8. Travel Allowances

9. Medical Aid for Retired Employees

10. Contact the HRTorQue Team |

| 1. Affirmative Action Measures and Employment Equity |

| Author: Melany Bydawell |

• Have you implemented affirmative action measures to achieve Employment Equity?

• Have you conducted an analysis and consulted with employees?

We are able to assist you in conducting an objective cultural and perception survey. Contact Melany Bydawell on [email protected] for further information.

In terms of Employment Equity Act, 55 of 1998, issued in terms of Section 25(1) - Duties of a Designated Employer: Section 13

| a. |

A designated employer must implement affirmative action measures for designated groups to achieve employment equity. |

| b. |

In order to implement affirmative action measures, a designated employer must:

• Consult with employees

• Conduct an analysis |

Affirmative Action measures: Section 15 states that:

| a. |

Affirmative action measures are measures intended to ensure that suitably qualified employees from designated groups have equal employment opportunity and are equitably represented in all occupational categories and levels of the workforce. |

| b. |

Such measures must include:

• Identification and elimination of barriers with an adverse impact on designated

groups

• Measures that promote diversity

• Making reasonable accommodation for people from designated groups

• Retention, development and training of designated groups (including skills

development)

• Preferential treatment and numerical goals to ensure equitable representation.

This excludes quotas. |

Consultation: Sections 16 and 17 states:

A designated employer must take reasonable steps to consult with representatives of employees representing the diverse interests of the workforce on the conducting of an analysis with employees from across all occupational categories and levels of the employers workforce, from designated groups and employees who are not from designated groups.

Analysis: Section 19

A designated employer must conduct an analysis of employment policies, practices, procedures, and working environment so as to identify employment barriers that adversely affect members of designated groups. |

| Top of Page |

| |

| 2. Should alcohol be permitted at work functions? |

| Author: Melany Bydawell |

2014 is coming to an end and with this comes the celebrations and functions that are either held at the employer's premises or off site. Either way the question often arises as to what, if any, the employer's obligations are when providing alcohol at these functions.

In terms of the OHS Act General Safety Regulation 2A. Intoxication.

| 1. |

An employer or a user, as the case may be, shall not permit any person who is or who appears to be under the influence of intoxicating liquor or drugs, to enter or remain at a workplace. |

| 2. |

No person at a workplace shall be under the influence of or have in his or her possession or partake of or offer any other person intoxicating liquor or drugs. |

Employee 'intoxication' is a major concern and you will note that the OHS Act has placed upon employers the duty of prohibiting persons to enter or remain at a workplace who appear to be under the influence of intoxicating liquor or drugs.

These restrictions, together with COIDA and the implications of a possible injury on duty, has legal implications for employers and they should ensure that not only is it vital that these provisions be communicated to all employees, but that you keep a record of these communications. Employers should be in a position to demonstrate that they have made an effort to try and manage employees' conduct around alcohol consumption, or preventing them from driving when over the legal limit or in an intoxicated state during these functions.

At social functions on the employer's premises, the employer should ensure that employees have 'signed off duty' prior to commencement of the function. This will avoid any possible claims of 'injuries on duty', and consider the following steps to reduce possible liability:

| • |

Advise employees regarding the desired behaviour during work functions. This could include the employer limiting the number of drinks for the duration of the function. |

| • |

Providing access to breathalyser tests. |

| • |

Place a disclaimer in the area or pub. |

Whilst year-end functions should be occasions to unwind and relax with colleagues outside of the normal working environment, both employers and employees still have certain responsibilities around their conduct, and would be expected to consider that both interests are not negatively affected. |

| Top of Page |

| |

| 3. Let the Truth be Told |

| Author: Dale Horne, Director - Whistle Blowers (Pty) Ltd |

The recent global 'ACFE Report to the Nations on Occupational Fraud and Abuse 2014' global fraud study gives a clear indication that the honest employees are no longer accepting dishonesty.

The experience of the directors of Whistle Blowers, gained during their many years within specialised police units, handling sensitive information, has led to a skilled team at Whistle Blowers being able to gather accurate information to get to the bottom of a particular illicit activity to aid in investigation, without exposing the identity of a whistleblower. The trust relationship between the whistleblower and the Whistle Blowers staff is regarded as of the utmost importance and the whistleblower is guided throughout the process of disclosing information. At no time would Whistle Blowers make the identity of a whistleblower known.

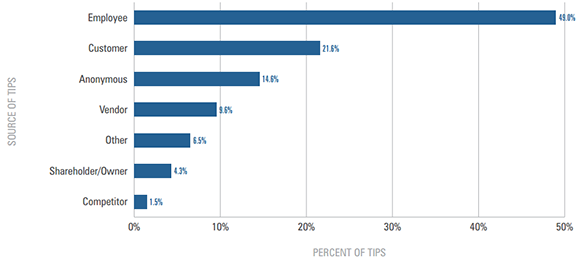

The graph below indicates the method by which dishonesty has been identified. Tips from employees are by far in the majority.

Source of Tips:

Contact Melany Bydawell if you'd like to make contact with Dale: [email protected]. |

| Top of Page |

| |

| 4. Medical Certificates - Traditional Healers |

| Author: Melany Bydawell |

Are you required to accept medical certificates issued by traditional healers?

From 1 May 2014, certain provisions of the Traditional Health Practitioners Act came into effect and the establishment of the Interim Traditional Health Practitioners Council of South Africa ("the Council").

In terms of the Basic Conditions of Employment Act of 1997 (Section 23(2), a medical certificate will only be valid if it has been issued and signed by a person who is certified to diagnose and treat patients, and who is registered with a professional council established by an Act of Parliament and, until the regulations are promulgated, employers are not required to recognise a medical certificate issued by anyone who is a traditional healer at this stage.

At the time that registration with the Council is possible, employers should request that certificates from traditional healers, as with those from medical practitioners, has reference to a registration number with the Council. |

| Top of Page |

| |

| 5. National Treasury to Delay Implementation of National Retirement Reform |

| Author: Karen van den Bergh |

In a slightly surprising move, Cosatu managed to convince National Treasury to delay the implementation of the proposed National Retirement Reform to 2017. It seems that this will apply to all the proposed T-Day implementations.

In short:

| • |

Harmonisation of retirement benefits will not take place. The 27,50% (capped at R350,000) will not be implemented and the current status quo will remain. |

| • |

Provident Funds will not be changed to Retirement Funds. |

It is important to note that Minister Nene still needs to table the final version of the Tax Administration Laws Amendment Bill in Parliament. |

| Top of Page |

| |

| 6. Employment Tax Incentive (ETI) |

| Author: Karen van den Bergh |

Since January 2014 we have had the Employment Tax Incentive in operation, and many companies have utilised this benefit by employing first time workers. There have been a few challenges with this act regarding how to implement it correctly. In the draft Taxation Laws Amendment Bill of 2014 the ETI was amended in some ways in an attempt to make this act more understandable and easier to implement.

SARS also published a few statements recently to assist in the understanding of certain definitions regarding the ETI.

The first of these statements deals with the qualifying age. The ETI act states in Section 6(a)(i) the following:

"6. An employee is a qualifying employee if the employee:

| (a) (i) |

is not less than 18 years old and not more than 29 years old at the end of any month in respect of which the employment tax incentive is claimed;" |

This has caused some confusion on the interpretation of the age qualification. Employers have been interpreting this from a number of different viewpoints. SARS has therefore issued the following clarification:

"With regards to the age requirement under section 6(a)(i) of the ETI Act, an employee will qualify in the month in which they turn 18 and will cease to qualify in the month in which they turn 30."

With this clarification it can now be seen that any employee who turns 18 years of age in a particular month will only qualify from that month onwards and will no longer qualify in the month that the employee turns 30 years of age.

Example:

An employee is 17 years of age and earns R3 500 per month. On the 25th June 2014 the employee will turn 18 years of age. This employee will qualify for the ETI from June 2014 onwards.

Another employee is 29 years of age and earns R5 500 per month. On the 8th September 2014 the employee will turn 30 years of age. This employee did qualify up to and including August 2014 and will no longer qualify from September 2014 onwards.

Some employers are also still in the dark about the "roll over" amount when claiming the ETI on their monthly EMP201's. The ETI act states that should there not be enough PAYE on the EMP201 to withhold the ETI, then the amount may be rolled over to the next month, up to a maximum of six months and up to a limit of R6 000 per qualifying employee. At the end of the six months, SARS would then reimburse the employer after evaluating if the employer is tax compliant. This re-imbursement can take place over the next six month period, should the employer not be tax compliant when the re-imbursement is due. If the employer still fails to become compliant in this period, then the amount will be forfeited.

The Taxation Laws Amendment Bill (TLAB) stated that the re-imbursement methods will be announced in the 4th quarter of 2014. SARS did issue the following statement recently regarding this:

"The refund process is expected to be introduced in the last quarter of 2014 and a final pay-out date will be announced soon.

Important facts about refunds:

| • |

ETI not used at 31 August 2014 |

| |

| - |

Is the "ETI not Utilised" amount on the August (201408) Employer Reconciliation Declaration (EMP501). |

| - |

This amount won't be allowed to be carried forward as the "ETI Brought Forward" amount on the September (201409) Monthly Employer Declaration (EMP201). |

| - |

The "ETI Brought Forward" amount on the September (201409) EMP201 must be zero. |

|

Top Tip: This amount, "ETI not Utilised", will be ring-fenced for refunding purposes, once the refund process is implemented.

| • |

ETI not used at 28 February 2014 |

| |

| - |

Any amount of ETI not used to reduce the Employees' Tax amount payable at 28 February 2014 could be included as an ETI carried forward amount. |

| - |

This amount could be included in the ETI brought forward amount on the March 2014 (201403) EMP201. |

| - |

This is the only time a rollover amount will be carried forward to the next reconciliation period. |

| - |

This was necessary as no refund will be paid for an ETI carry forward amount at the end of February 2014. |

|

Top Tip: Where the ETI amount not used at 28 February 2014 was included in the ETI brought forward amount on the EMP201 for March to August 2014 and was not used in full to reduce the Employees' Tax amount payable over these months, the amount will be included in the "ETI Not Utilised" amount at 31 August 2014. This amount will be considered for refund purposes, once implemented."

It is imperative that the "ETI Amount not Used" must be declared in the interim period submissions so that when the actual date for the re-imbursement is announced, the employers will be ready for this.

The TLAB deals with a further area of concern in the ETI. This item will be in force from 1 March 2015.

This amendment is to deal with the "gross up" calculation for an employee who only works for a part of a month. The amendment basically states:

| • |

Grossing up is only required for employees not employed for a full month. |

| • |

Any employee who works less than 160 hours in a month must be grossed up to the 160 hours for the month. |

| • |

Employees who work for more than 160 hours must use the actual remuneration earned for the month. |

| • |

Employees who work only a part of a month, but who are employed for the month as per their contract (i.e. those who are employed for the month but only work 2/3/5/6 etc. days in the month, or mornings only, or 6 weeks working then 2 weeks off) do not have to be grossed up as their remuneration is for the full month. |

The new amendment states the following:

"If an Employer employs a qualifying employee for less than 160 hours in a month, the employment tax incentive to be received in respect of that month in respect of that qualifying employee must be an amount that bears to the total amount calculated in terms of subsection (2) or (3) the same ratio as the number of hours that the qualifying employee was employed by the employer in that months bears to the number 160."

This deal with hours employed and not hours worked that must be grossed up to the 160 hours. This means:

| • |

For every employee that has been employed for less than 160 hours p/m a "gross up" calculation will have to be done; |

| • |

And that contractual hours (not actual hours) are captured and available in the payroll to do the required calculation (accurately!). |

For casual employees (fluctuating hours) the Employer will have to capture hours worked every month in order to "gross up" correctly, which will be an admin burden. |

| Top of Page |

| |

| 7. Bursaries / Scholarships |

| Author: Karen van den Bergh |

With the changes that have occurred for bursaries and scholarships, SARS has released the correct way that these should be reported on the tax certificates. To understand what is meant by the different codes, here is a brief reminder of how these bursaries or scholarships work:

| • |

All bursaries and scholarships must be for study at a recognised and accredited institution. |

| • |

All open bursaries or scholarships are exempt from tax. |

| • |

If an employee has a deemed remuneration (last year remuneration) of R250 000 per annum or less, they will qualify for the exemptions. |

| • |

If the employee or their relative is granted a scholarship to study up to NQF Level 4 (Grade 12 or Matric), the first R10 000 is tax free. |

| • |

If the employee or their relative is granted a bursary to study at levels NQF Level 5 to NQF level 10 (Further Education and Training Certificate to Doctorate), the first R30 000 is tax free. |

| • |

Any amounts above the exemptions is taxable, and if the employee earns more than the deemed remuneration limit, the full amount is taxable. |

Example:

Mr X has two children, the younger is busy completing Grade 11 at school and the older child is at university. Mr X's deemed remuneration is R 220 000. He applies for the scholarship and bursary for his two children. The company awards a scholarship of R15 000 to the younger child and a bursary of R 35 000 to the older child. The taxable portion will be as follows:

• Younger Child taxable portion is R5 000. R15 000 - R10 000. The first R10 000 is exempt.

• Older Child taxable portion is R5 000. R35 000 - R30 000. The first R30 000 is exempt.

This will be reflected as follows on the Tax Certificate:

R5 000 - Code 3809, Taxable Bursaries or Scholarships (PAYE)

R10 000 - Code 3815, Non-Taxable Bursaries or Scholarships (Excl)

R5 000 - Code 3820, Taxable Bursaries or Scholarships - Further Education (PAYE)

R30 000 - Code 3821, Non-Taxable Bursaries or Scholarships - Further Education (Excl). |

| Top of Page |

| |

| 8. Travel Allowances |

| Author: Karen van den Bergh |

Over the past few months, it has come to light that the SARS special audit division have been doing checks on the tax certificates of some major companies dating back five years, specifically targeting the Travel Allowances as recorded on these certificates. Currently only major corporates have been looked at, but a number of tax practitioners who have been involved with their clients regarding this have stated that due to the success of this audit so far, SARS will be checking all certificates for the same issues. In the first three months of the audit they able to recover over R 2.5 million in taxes.

The following must be taken into account to ensure that your Travel Allowances are correct:

| • |

Only employees who are required to travel for work, using their own vehicles, are entitled to a travel allowance that is taxed with the 80/20% rule. |

| • |

Always use the SARS table for fixed and fuel costs when determining the value of the travel allowance. |

| • |

Employees who have a travel allowance must keep a detailed log book of all their business and private travel. |

| • |

The allowance can be in the form of a cash amount paid upfront or a petrol or fleet card (must be recorded). |

| • |

Cash allowances and petrol/fleet card amounts must be recorded through the payroll. |

| • |

Cash allowances and petrol/fleet cards are reported against tax certificate code 3701 - Travel allowance. |

| • |

Re-imbursive travel allowances are when the employee puts in a physical claim per kilometre. |

| • |

Re-imbursive claims must be recorded in payroll. |

| • |

Re-imbursive claims that: |

| |

| - |

Do not exceed 8 000 km in a tax year; and |

| - |

Do not exceed the SARS rate per kilometre (currently R3.30); and |

| - |

Are not paid where a cash travel allowance or petrol/fleet card is given, |

|

| |

are to be recorded against tax certificate code 3703 - Re-imbursive travel non-taxable. |

| • |

Re-imbursive claims that: |

| |

Do exceed 8 000 km in the tax year; or

- Are paid above the SARS rate per kilometre; and

- Are paid with a cash travel allowance or petrol/fleet card,

- Are paid in conjunction with a standard travel allowance or petrol/fleet card,

are to be recorded against tax certificate code 3702 - Re-imbursive travel taxable. |

Please note: Re-imbursive travel allowances are not taxed through payroll at any time. These will be taxed on assessment. |

| Top of Page |

| |

| 9. Medical Aid for Retired Employees |

| Author: Karen van den Bergh |

There are many companies who pay medical aid contributions for their employees who are legally retired. This does seem to cause confusion as all normal employees enjoy the benefit of the recently implemented medical tax credits only and no longer get the pre tax deduction as was the case in the past.

Employees who are disabled or over the age of 65 years and who are retired, work on a different scheme. They still enjoy medical tax credits, but in many cases this is only available on assessment. Where they still receive the pension or retirement payment from the company, they can opt to have the tax credits deducted from PAYE on a monthly basis through the payroll, as any other employee does. The major difference with these legally retired employees, is that the company paid portion of the medical aid contribution is not deemed a fringe benefit.

The reporting of this has not yet been finalised by SARS, and this will probably be clarified before March 2015. Currently the reporting is as follows:

Company contribution - 4493

Employer's medical aid contributions in respect of an employee who qualifies for the "no value" provisions in the 7th Schedule.

Employee contribution - 4005

Medical Aid contribution.

Please note that the rules for this reporting state that if code 4493 is used, you must not use code 3810 - Medical aid contributions (subject to PAYE). |

| Top of Page |

| |

| 10. Contact the HRTorQue Team |

Head Office (Durban)

Phone: 031 564 1155

Fax: 031 564 1228

Email: [email protected]

Website: www.hrtorque.co.za

Address: 163 Umhlanga Rocks Drive

Durban North, KwaZulu-Natal |

| |

|

| |

Sales

Melany Bydawell: 031 582 7425

[email protected] or 083 441 5618

Payroll & HR Administration

Karen van den Bergh: 031 582 7413

[email protected] or 082 891 1722

Human Resources / Employee Relations

Melany Bydawell: 031 582 7425

[email protected] or 083 441 5618 |

|

|

|

|

|

|